OPM SF 2817 2011-2025 free printable template

Show details

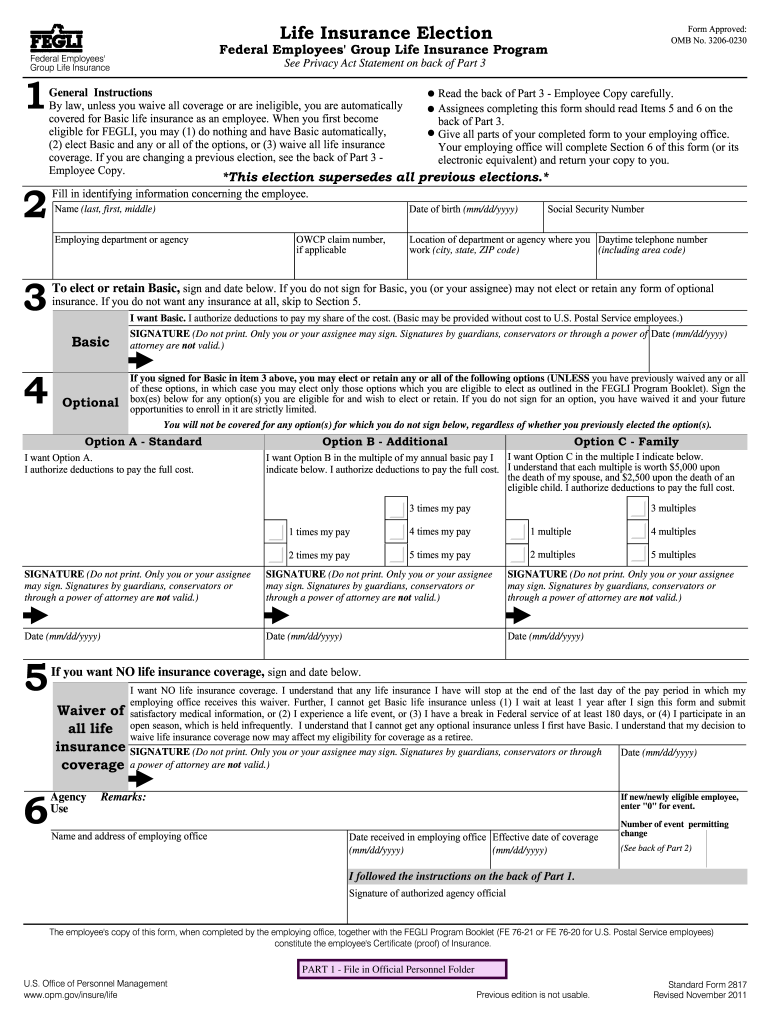

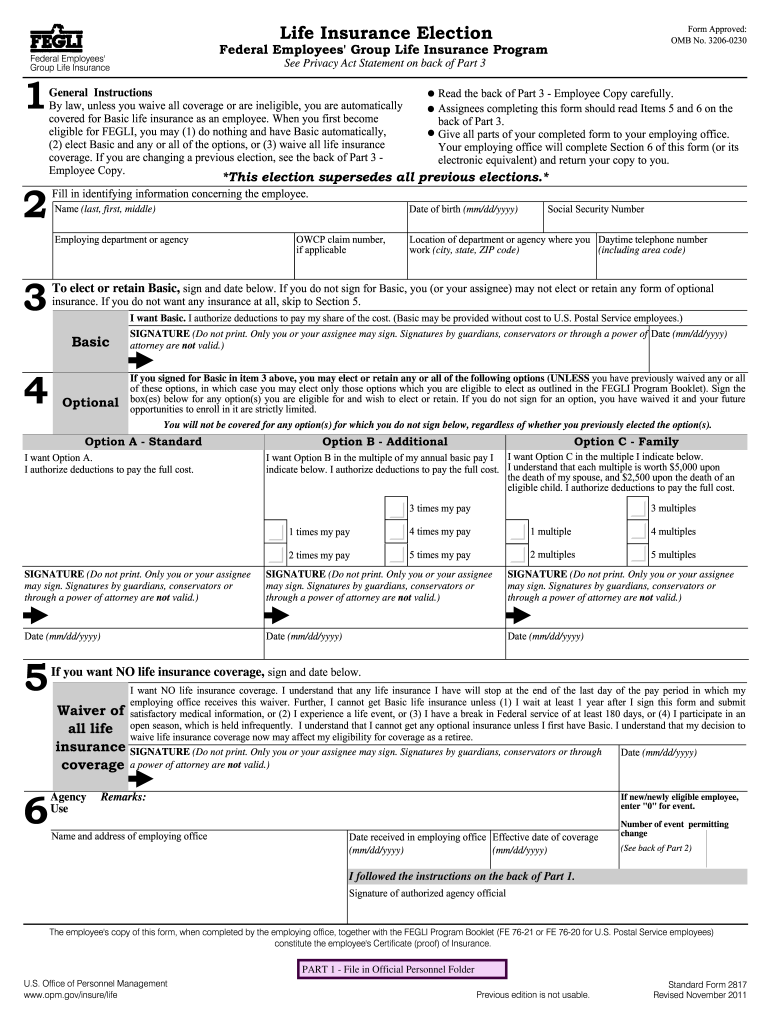

If approved the employee should make the election on the SF 2817 and submit to the employing agency. Otherwise Coverage is effective the first day receipt of the SF 2817. Time Limit - Employee must submit the SF 2817 and be OFEGLI s approval. If employee is not in a pay and duty status or doesn t submit the SF 2817 within those 60 days Option A does not become effective and the employee must start over. Time Limit - Agency must receive the SF 2817 and proof of the event within 60 days after...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign standard form 2817

Edit your sf 2817 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sf 2817 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit federal form 2817 form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2817 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OPM SF 2817 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out opm life insurance form

How to fill out OPM SF 2817

01

Obtain the OPM SF 2817 form from the official website or your HR department.

02

Read the instructions carefully at the top of the form.

03

Fill out your personal information in Section 1, including name, address, and contact details.

04

In Section 2, indicate the type of insurance coverage you are applying for.

05

Provide information about your current insurance coverage, if applicable, in Section 3.

06

In Section 4, make sure to fill out the beneficiaries' information accurately.

07

Review the completed form for any errors or missing information.

08

Sign and date the form at the bottom.

09

Submit the completed form to your HR department or the appropriate agency.

Who needs OPM SF 2817?

01

Federal employees looking to enroll in life insurance programs.

02

Retirees who want to continue their life insurance coverage.

03

Individuals who are changing their life insurance coverage or beneficiaries.

Fill

sf 2821

: Try Risk Free

People Also Ask about retirement application

What is SF 2817?

An employee may at any time file an SF 2817 to waive or reduce coverage, unless the employee has assigned his/her insurance coverage. If the employee has assigned the insurance, only the assignee(s) may waive or reduce the coverage (except for Option C which cannot be assigned).

What is the purpose of SF 2821?

The SF 2821 should be completed to reflect the retiring employee's insurance status at the time of separation for retirement and attached to the Application for Retirement.

What is an SF 2818 form?

Federal Employees' Group Life Insurance (FEGLI) Program. Instructions for Completing this SF 2818. Complete this form when you retire or when you are receiving compensation payments from the Office of Workers' Compensation Programs (Department of Labor) and your FEGLI coverage as an employee ends.

Do federal employees get free life insurance?

In most cases, if you are a new Federal employee, you are automatically covered by Basic life insurance and your payroll office deducts premiums from your paycheck unless you waive the coverage.

How to claim federal employee life insurance?

Please call the Office of Federal Employees' Group Life Insurance (OFEGLI) at 1-800-633-4542 to file a FEGLI claim. When making the call, mention the emergency situation. Specially designated personnel will take your claim over the phone.

What is SF 2817?

Eligible employees enroll through their servicing human resources office. They can enroll by completing SF 2817 "Life Insurance Election" (some agencies have electronic enrollment). For information on obtaining the SF 2817 or on how to enroll in the FEGLI Program as a Federal employee, visit the enrollment page.

How much is basic life insurance for federal employees?

The Federal Employees' Group Life Insurance Program (FEGLI) offers Basic Life Insurance that is equal to your annual basic pay, rounded to the next higher $1,000, plus $2,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in opm standard form 2817 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit sf2817 pdf and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the va form sf 2817 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your form 2817 opm in seconds.

How do I edit sf 2822 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing sf 2817 fillable right away.

What is OPM SF 2817?

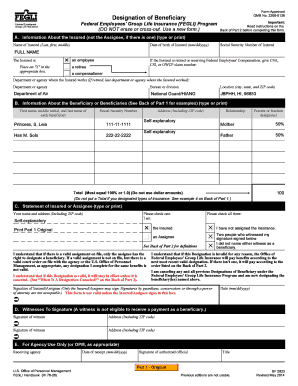

OPM SF 2817 is a form used for designating a beneficiary under the Federal Employees' Group Life Insurance (FEGLI) program.

Who is required to file OPM SF 2817?

All federal employees and retirees who wish to designate or change their life insurance beneficiaries are required to file OPM SF 2817.

How to fill out OPM SF 2817?

To fill out OPM SF 2817, start by providing personal information including your name, address, and social security number. Then, list the names and details of the beneficiaries you wish to designate, indicating the share of benefits each will receive, and finally sign and date the form.

What is the purpose of OPM SF 2817?

The purpose of OPM SF 2817 is to allow federal employees to specify who will receive their life insurance benefits in the event of their death.

What information must be reported on OPM SF 2817?

The information that must be reported on OPM SF 2817 includes the employee's personal details, the beneficiary's name, relationship to the employee, social security number, address, and the percentage of benefits each beneficiary will receive.

Fill out your OPM SF 2817 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Opm Sf 2817 is not the form you're looking for?Search for another form here.

Keywords relevant to opm form sf 2817

If you believe that this page should be taken down, please follow our DMCA take down process

here

.